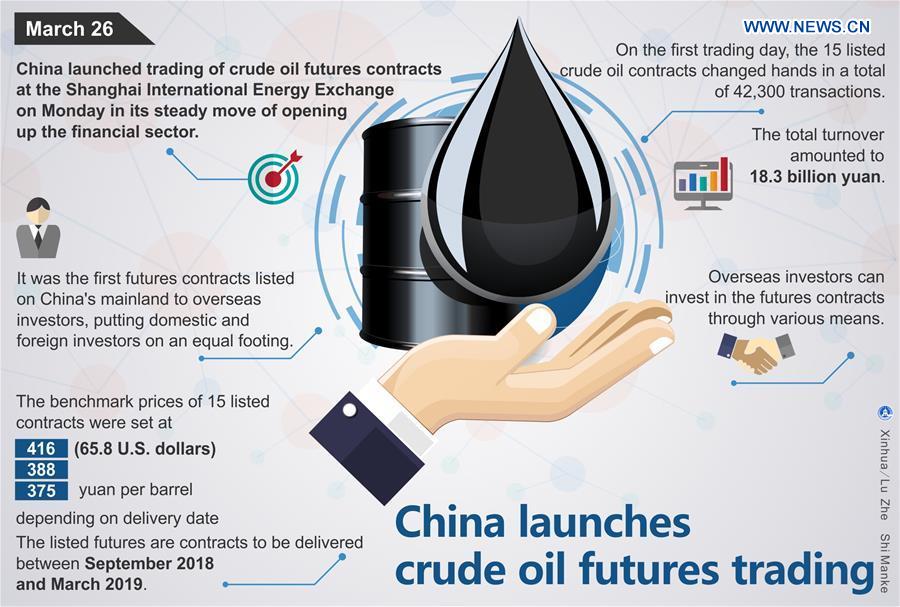

The graphic shows that China launched trading of crude oil futures contracts on March 26, 2018. China launched trading of crude oil futures contracts at the Shanghai International Energy Exchange on Monday in its steady move of opening up the financial sector. It was the first futures contracts listed on China's mainland to overseas investors, putting domestic and foreign investors on an equal footing. (Xinhua/Lu Zhe/Shi Manke)

by Xinhua writers Liu Jie, Fang Ning and Chen Aiping

SHANGHAI, March 26 (Xinhua) -- China launched trading of crude oil futures contracts at the Shanghai International Energy Exchange on Monday in its steady move of opening up the financial sector.

It was the first futures contracts listed on China's mainland to overseas investors, putting domestic and foreign investors on an equal footing.

Overseas investors can invest in the futures contracts through various means. At the beginning, U.S. dollars can be used for deposit and for settlement. In the future, more currencies will be used for deposits.

Li Qiang, Shanghai's Party chief, and Liu Shiyu, chairman of China Securities Regulatory Commission, hit the gong together to open the trading session.

The listed futures are contracts to be delivered between September 2018 and March 2019. The benchmark prices of 15 listed contracts were set at 416 yuan (65.8 U.S. dollars), 388 yuan and 375 yuan per barrel, depending on delivery date.

The price of SC1809 contracts started at 440 yuan per barrel and closed at 429.9 yuan per barrel, which is 3.34 percent higher than the benchmark price. The total turnover hit 17.6 billion yuan.

On the first trading day, the 15 listed crude oil contracts changed hands in a total of 42,300 transactions. The total turnover amounted to 18.3 billion yuan.

Trading margins for the futures were set for 7 percent of the contract value. The upward and downward trading limits were set at 5 percent, with the trading limits on the first trading day set at 10 percent of the benchmark prices.

Analysts expected sufficient demand for the crude futures contracts from both industrial and financial clients as they needed a tool to manage risk, and hedge against inflation.

Individual investors can also benefit from the launch as their interests are better protected in exchanges rather than through over-the-counter trading.

China is the world's largest importer of crude oil, and the introduction of crude oil futures contracts represents a milestone for China's futures market, said David Martin, Asia Pacific Head of Global Clearing at J.P. Morgan.

J.P. Morgan is pleased to offer the futures contracts in China to global clients immediately, he noted.

Yang Xiaoping, president of BP China, said China's crude oil futures offer companies in the real economy a hedging tool that can better reflect market conditions in Asia.

The Asia-Pacific region has surpassed America and Europe in crude consumption. China is the world's second-largest oil consumer after the United States. The country imported 420 million tonnes of crude oil in 2017, ranking first in the world.

China set up a petroleum exchange in the early 1990s but soon ceased trading due to reform and market factors.

Zhang Hao, chair of CITIC Futures Co. Ltd., said that more futures markets, such as iron ore, are expected to open to offshore investors.

(Xinhua correspondents Xu Xiaoqing and Gao Fan contributed to the story)